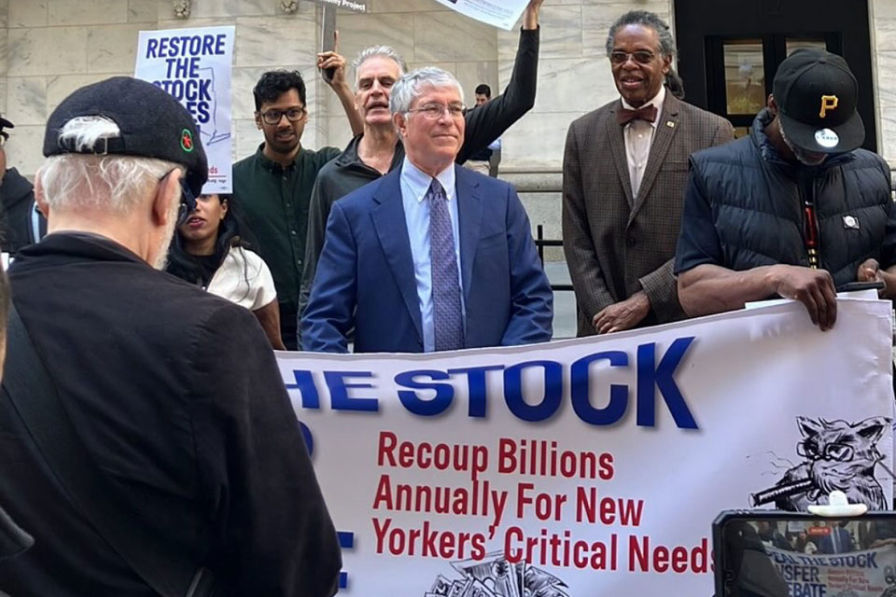

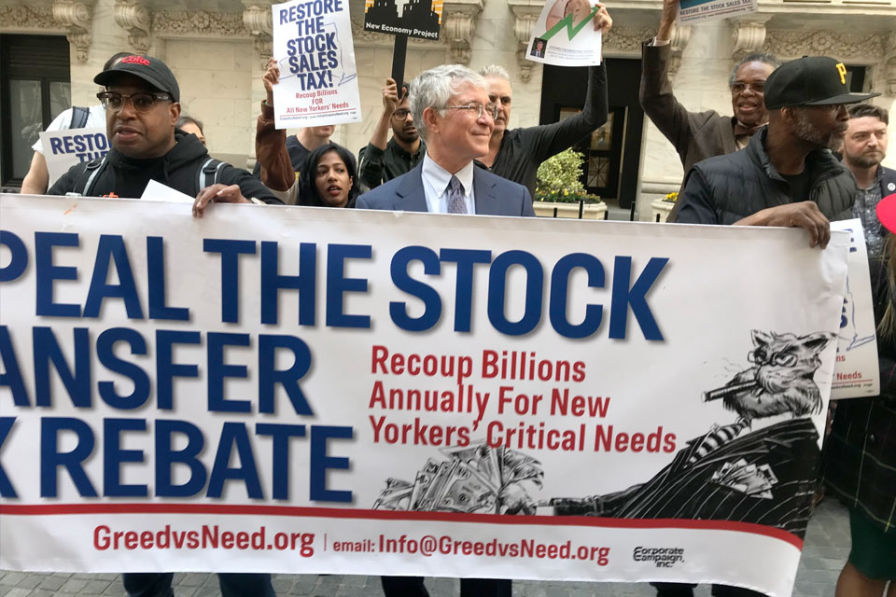

Lt. Gov. Delgado supports stock transfer tax to reinvest in Black and Brown communities

"Lt. Governor Delgado's historic decision, if elected, to end the stock transfer tax rebate should motivate the majority of educated voters who believe in justice for all and that dire poverty, homelessness and crumbling infrastructure should cease to exist, to vigorously campaign and vote for him" added Rogers.

Amsterdam News (01/15/26)